accumulated earnings tax reasonable business needs

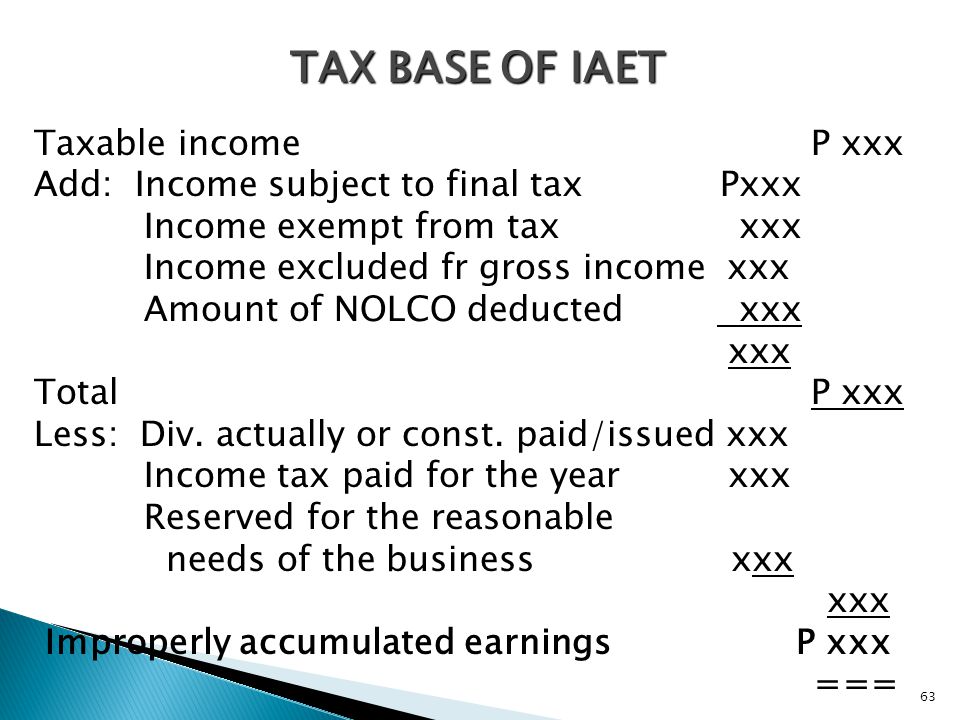

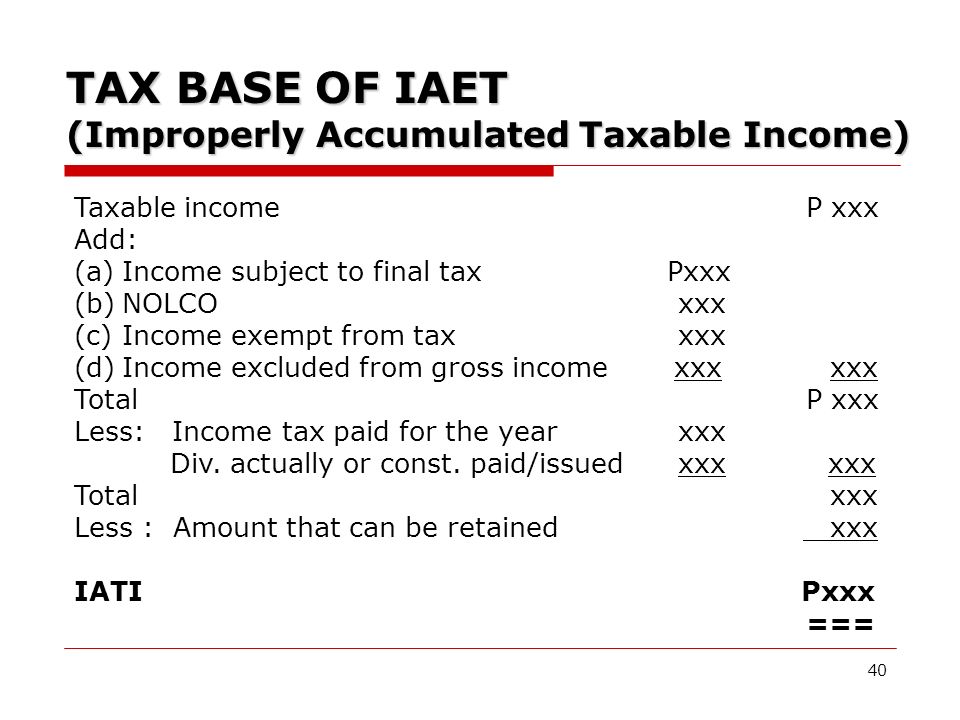

The PHC tax is self-imposed. THE ACCUMULATED EARNINGS TAX AND THE REASONABLE NEEDS OF THE BUSINESS.

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

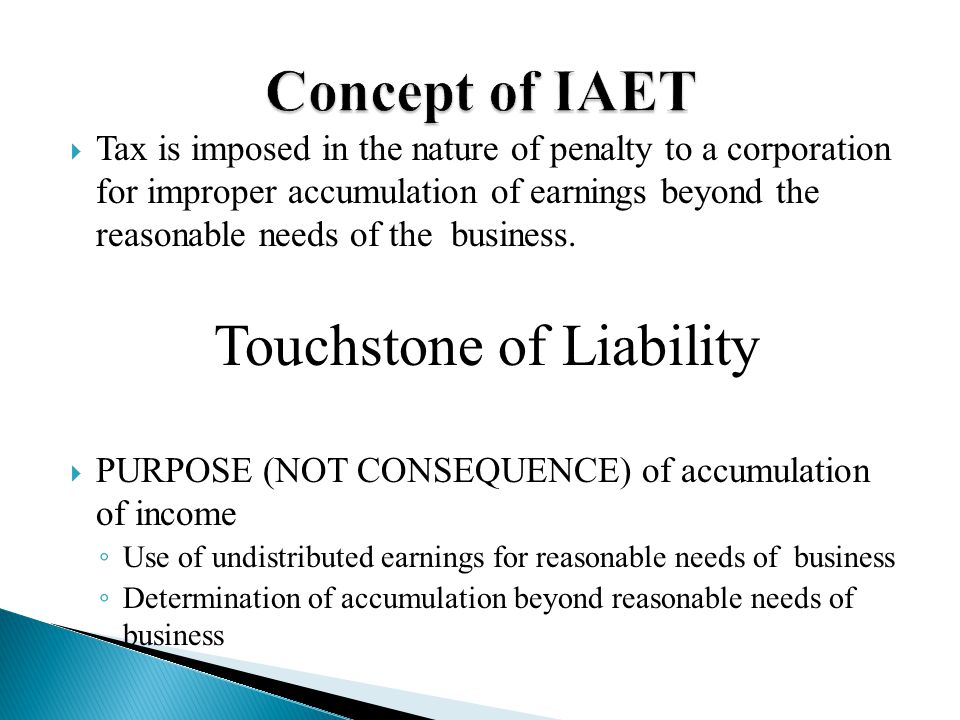

The AET is a penalty tax imposed.

. The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis- courage the use of a corporate umbrella for personal income. The issue will be dropped if it is concluded that earnings. This tax is raised and imposed by the IRS whereas the personal holding company tax is basically mechanical.

When the PHC tax applies there is. The extent to which earnings and profits have been distributed by the corporation may be taken into account in determining whether or not retained earnings and profits exceed the. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

To avoid having to pay for accumulated earnings tax Company A has to distribute at least 100000 of net income as dividends. Reasonable business needs versus tax avoidance by Machinery and Allied Products Institute 1967 edition in English It looks like youre offline. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the.

Once again the tax can be levied if the IRS identifies that a corporation is withholding dividends and accumulating earnings for reasons other than reasonable needs of. Trol is shifted The crucial issue for purposes of the tax on accumulated earnings is whether the accumulation should be characterized as under-taken for the corporations reasonable. Have been accumulated for the reasonable needs of the business or beyond such needs is dependent upon the particular circumstances of the case.

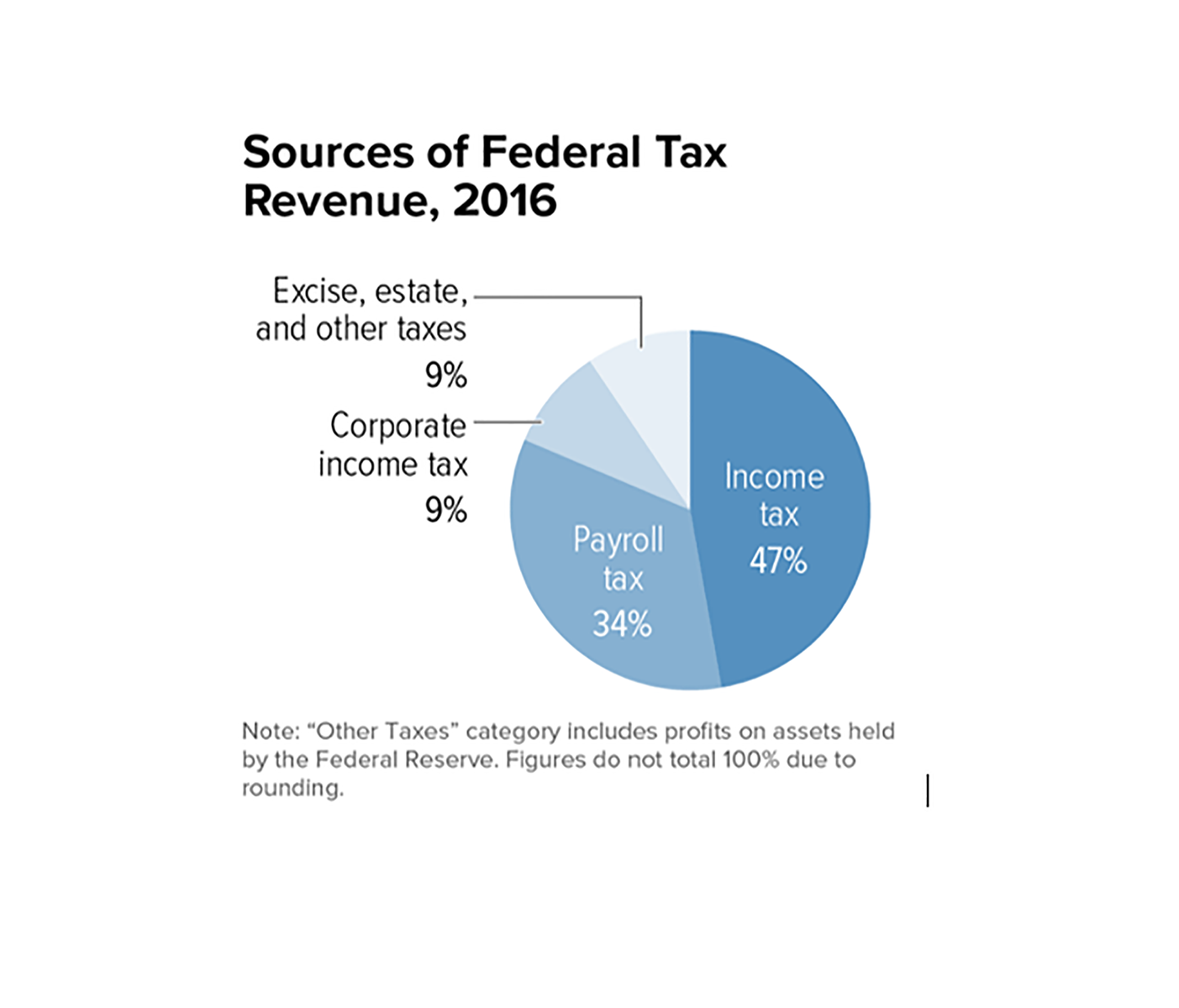

This is a federal tax levied on businesses that are considered invalid and have above-average incomes. Reasonable business needs versus tax avoidance Machinery and Allied Products Institute and Council for Technological Advancement. The accumulated earnings tax has been referred to as a.

The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. Easily Approve Automated Matching Suggestions or Make Changes and Additions. The accumulated earnings tax.

Title The accumulated earnings tax. 1 Accumulated taxable income is. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business.

Tax on Accumulated Earnings. The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business. 1537-2a Income Tax.

Essentially the accumulated earnings tax is a 15. Tion of earnings beyond the. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax.

Consideration should be given to the relationship between IRC 531 Imposition of accumulated earnings tax IRC 541. 150000 200000 - 100000 250000. This tax was created to discourage companies from.

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Taxation Of Shareholder Loans Canadian Tax Lawyer Analysis

/GettyImages-185121887-3537e49a2e394fe5927d3cfb1dd0a8fb.jpg)

Accumulated Earnings And Profits Definition

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

How To Structure A Trading Business For Significant Tax Savings

Doing Business In The United States Federal Tax Issues Pwc

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

:max_bytes(150000):strip_icc()/a_10-5bfc387746e0fb0051486be9.jpg)