dependent care fsa limit 2021

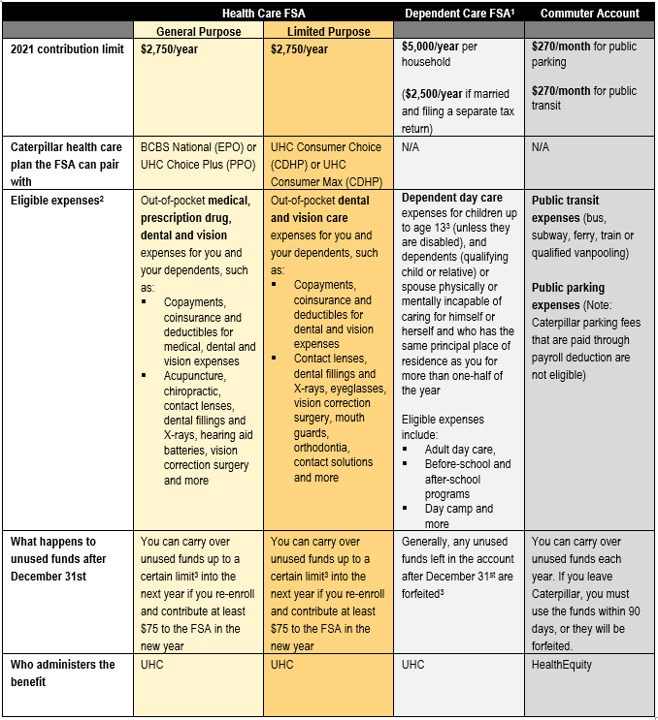

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. The new DC-FSA annual limits for pretax contributions increases to 10500 up from.

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules Don T Mess With Taxes

Hello Members of the Community.

. For 2021 only the DCFSA contribution limit for qualifying dependent care expenses is increased from 5000 to 10500 for individuals or married couples filing jointly and from 2500 to. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married. WASHINGTON The Internal Revenue Service today provided greater flexibility due to the pandemic to employee benefit plans offering.

WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan. FSA Dependent Care Limit Raised in 2021.

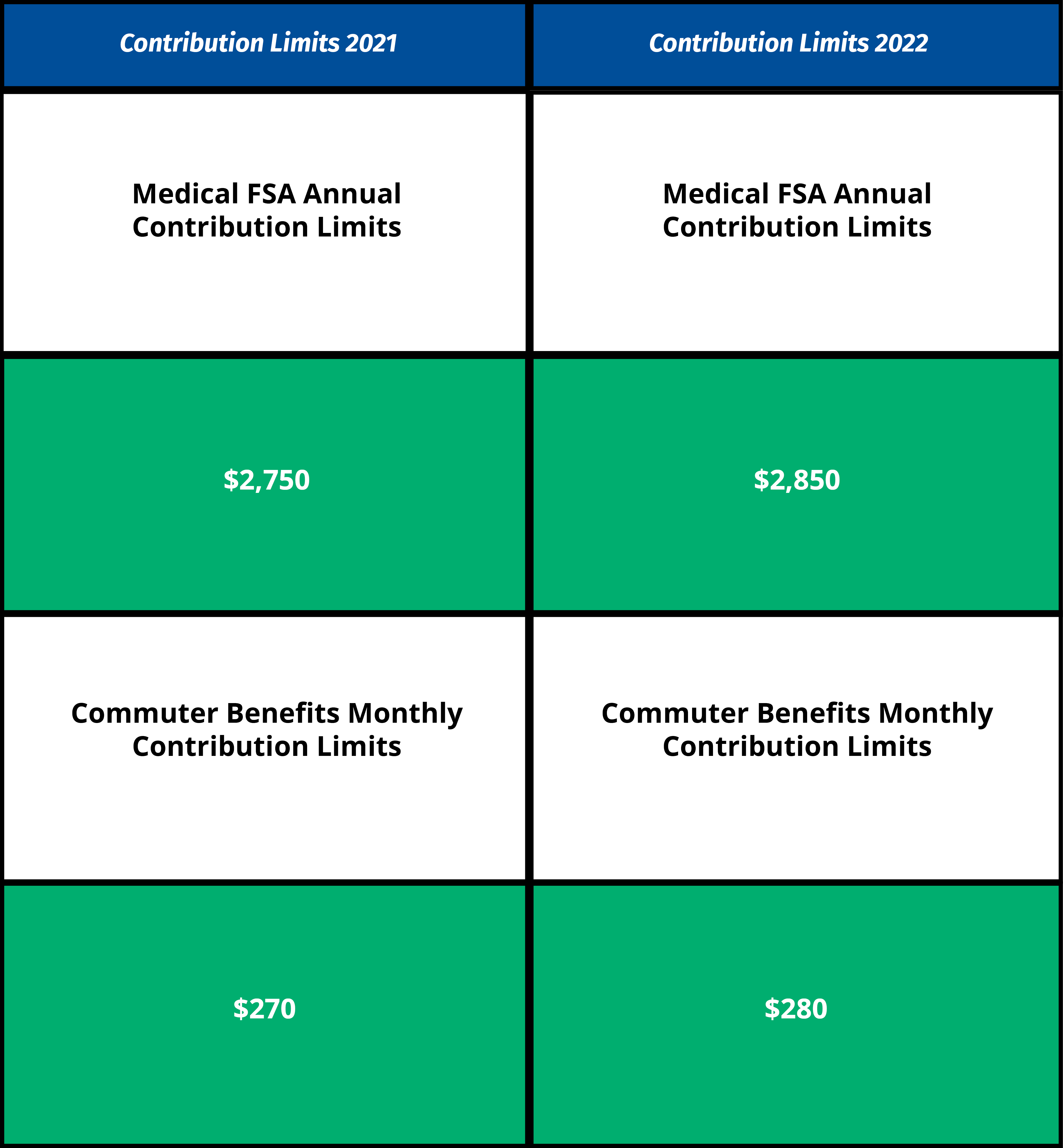

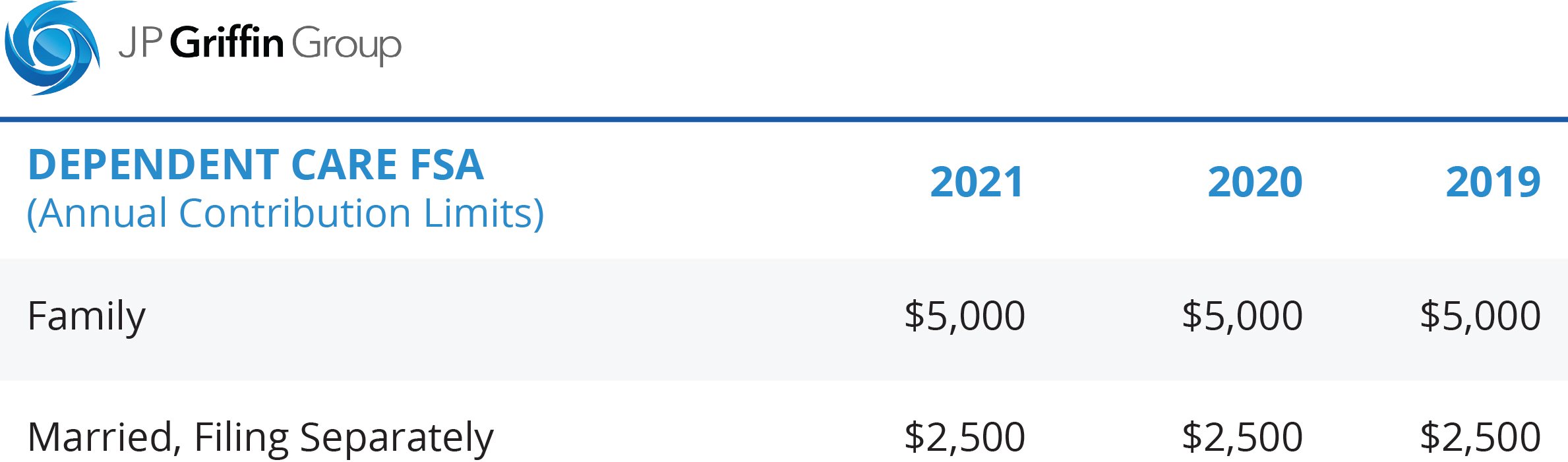

FSA Dependent Care current contribution limits are 2500 for a Single or 5000 for a Married. Dependent Care FSA Limits Remain the Same for 2021 Unlike the health FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by. See below for the 2023 numbers along with comparisons.

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. See below for the 2023 numbers along with comparisons. It also increases the value of the dependent care tax credit for 2021.

Employer adopts the carryover provision that provides the employees 5000 dependent care FSA balance carries over into the 2021 plan year. FSA contributions cannot be returned in cash. IR-2021-40 February 18 2021.

The new Dependent Care FSA annual limit for 2021 pretax contributions increases to 10500 up from 5000 for single taxpayers and married couples filing jointly and to. For 2021 the American Rescue Plan Act of 2021 enacted March 11 2021 made the credit substantially more generous up to 4000 for one qualifying person and 8000 for. The limit has returned to 5000 for 2022.

The American Rescue Plan Act of 2021 was enacted on March 11 2021 making the Child and Dependent Care credit substantially more generous and potentially refundableup to 4000 for. See below for the 2023 numbers along with comparisons. Employer also adopts the.

The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married. The American Rescue Plan Act of 2021 introduced multiple provisions to provide assistance to organizations and individuals who have been impacted by COVID-19. The most money in 2021 that you can stash inside of a dependent care FSA is 10500.

The Savings Power of This FSA. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married.

2021 Irs Hsa Fsa And 401 K Limits A Complete Guide

Increase In Dependent Care Fsa Limit For 2021 Accounting Services Audit Tax And Consulting Aronson Llc

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

How Couples Can Maximize Their Dependent Care Fsa

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Six Fsa Dependent Care Guidelines From My Back To School Checklist Aspyre

Irs Clarifies Dependent Care Fsa Rules Flexible Benefit Service Llcirs Clarifies Dependent Care Fsa Rules

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Changes To Dcfsa Cdctc White Coat Investor

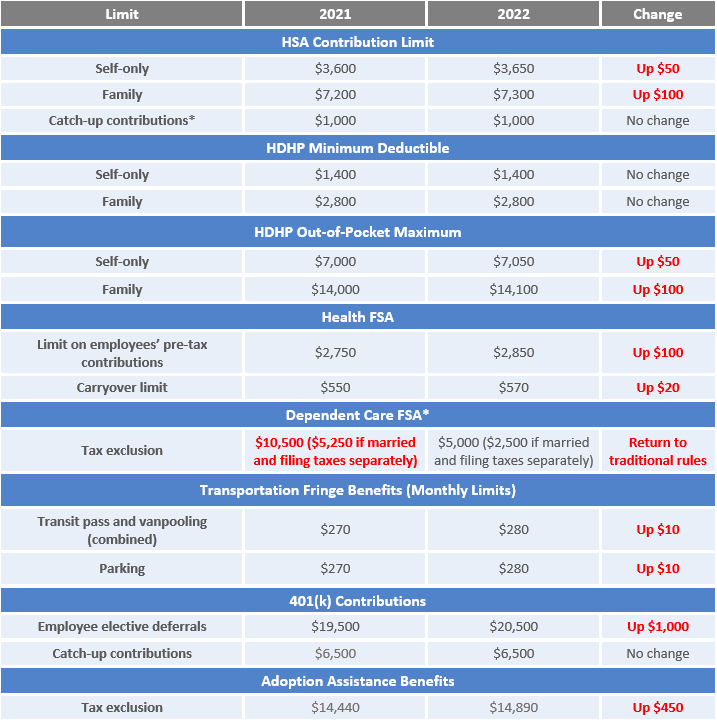

Compliance Overview Employee Benefit Plan Limits For 2022 Sanford Tatum Insurance In Lubbock Texas

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Irs Announces 2022 Health Fsa Transportation Plan Limits Bba